What Does It Mean If You Have An 800 Credit Score?

Feb 07, 2024 By Triston Martin

Introduction

The good news is that you don't need to have a perfect credit score of 850 to reap the benefits of having excellent credit. If you want the benefits of having an ideal credit score, you have to get your credit score above 800, which is considered outstanding. Experian found that only 2.1% of consumers had an outstanding credit score, while only 1.6% had a perfect score of 850.

When your credit score is in the 800s, you've demonstrated to lenders that you deserve credit. Lenders like banks and credit card companies are likely eager to lend you money and might even offer you preferential rates and terms. To those with a credit score of 800 or higher, the word "no" is rarely heard in response to a mortgage pre-approval letter or an application for a rental.

Factors:

- According to FICO, multiple causes include a rise in the average number of consumers with scores of 800 or above; and an increase in lenders that report approvals for credit lines of $80,000 or more.

- Fewer people missed payables. As of April 2021, the percentage of consumers who were 30 days behind on payment was 15%, down from 19.6% the year before.

- Bring down the debt. Over the past year, both credit card balances and use rates have decreased by more than 10% as customers have made significant efforts to reduce their debt.

- We have reduced efforts to obtain credit. From April 2020 to April 2021, there was a 12.1% decline in requests for new lines of credit.

How To Improve Your 800 Credit Score

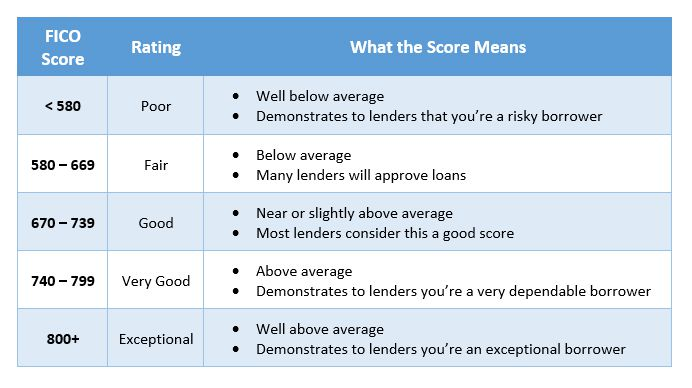

Credit scores in the 800 range are significantly higher than the national average of 711. It's close to the maximum Score, but there's still room for improvement. Moreover, you're close to the Very Good credit score category, with a score almost in the Exceptional area (740-799). A Very Good score isn't anything to worry about, but maintaining a score in the Exceptional level can increase your eligibility for the finest credit terms. Checking your FICO® Score is the most excellent approach to get an idea of what you can do to raise your credit rating. Your Score is already so high that it's unlikely any of those variables will make a significant difference, but there's always room for improvement.

What Percentage Of The Population Has A Credit Score Over 800?

When checking your credit, most lenders will utilise what is known as a FICO® Score. Each individual is given a credit score from 300 to 850 based on the FICO® scoring system. Three major factors in determining your FICO® Score are your payment history, credit utilisation, and account age. Since 2009, Americans' average credit scores have been on the increase. According to ExperianTM, 21.8% of customers now have a FICO® Score of 800 or higher. About 18.2% of the population in 2009 had a credit score of 800 or higher. In 2018, the average credit score in the United States reached 704, marking a new high point.

Best Credit Cards If Your Credit Score Is 800

With an 800 credit score, you can qualify for the best credit cards on the market, which often have better interest rates, rewards programs, perks, and initial sign-up bonuses. Those in search of a high-welcome-bonus credit card who don't require the perks of a luxury card often go for the x. Spend $4,000 on purchases during the first three months of creating your account, and you'll receive 60,000 bonus points. With a 1.25 cents per point redemption value through the travel site, the sign-up incentive could be worth $750 in travel rewards and much more with transfers to partners like United or Hyatt.

Contact Your Credit Card Issuers

You could start bargaining with your creditors for better interest rates now that you have an excellent credit score. Contact your creditors individually and explain that you'd like to negotiate a reduced interest rate because you've been a reliable client in the past.

Shop For New Car Insurance

If your credit score is 800 or higher and you shop around for vehicle insurance, you could save significant money. According to HighYa, an informational website for customers, auto insurers often pull credit reports to determine the possibility of claims. Get in touch with your current insurer and any companies you're considering switching to negotiate lower premium rates, thanks to your stellar credit score.

Conclusion:

Lenders will likely extend credit to you if your Score is 800 or higher. A higher credit rating may offer more favourable conditions for large purchases like homes and cars. There is a chance that you could be approved for a credit card that offers superior benefits, such as lounge access at airports or complimentary breakfast at select hotels.